Affordable Housing Lottery Opens for 241 Units in East New York, Starting at $471 a Month

An affordable housing lottery has opened for a whopping 241 newly constructed units across a series of buildings as part of the latest phase of the Nehemiah Spring Creek development, with addresses at 389-402, 498-504, and 516 Schroeders Avenue, 127 and 129 Gateway Drive and 1111-1123 Lower Ashford Drive in East New York.

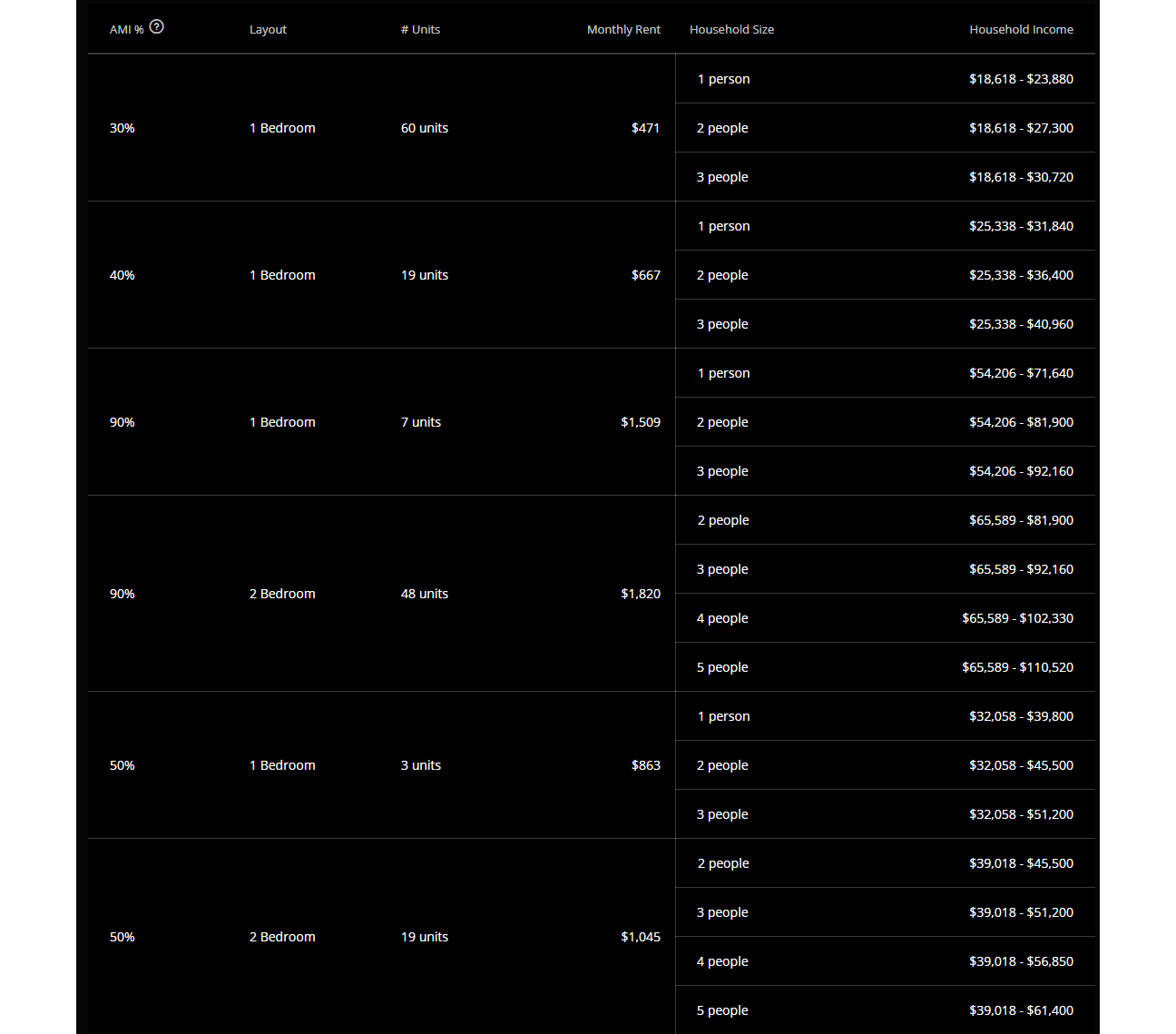

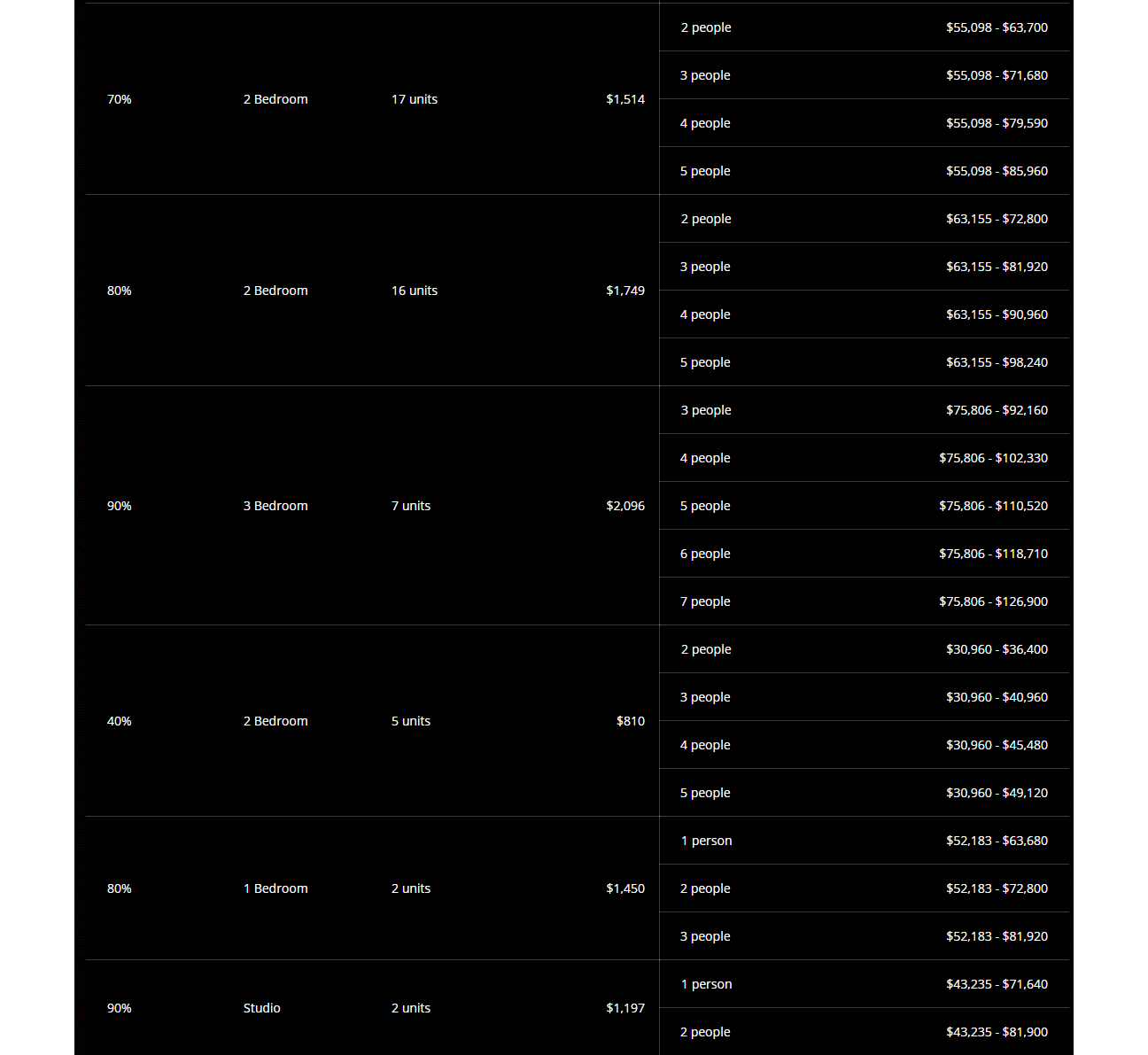

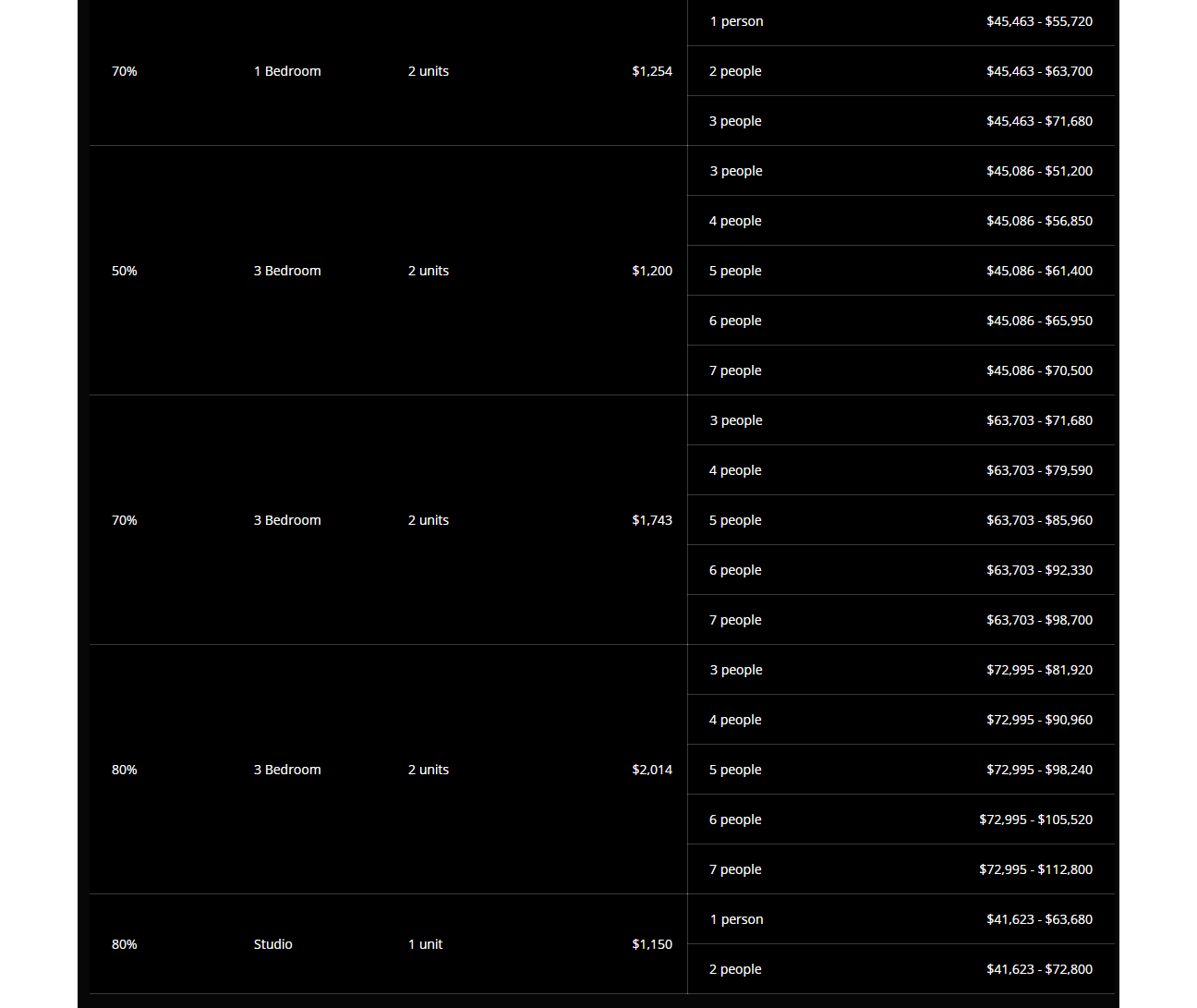

Of the affordable apartments, there are three studios, 93 one-bedroom units, 105 two-bedroom units and 13 three-bedroom units. Monthly rents start at $471 and top out at $2,096.

The lottery is set at an area median income range of 30 percent for 60 of the units, 40 percent for 24 of the units, 50 percent for another 24 of the units, 70 percent for 21 of the units, 80 percent for another 21 of the units and 90 percent for the remaining 64 units.

Eligible incomes range between $18,618 and $126,900 for households of one to seven people.

Sitting on 45 acres of former wetlands, and later landfill, the Nehemiah Spring Creek project has been in the works for many years. Nehemiah HDFC, the development offshoot of nonprofit East Brooklyn Congregations, put together the first three phases of the project; this and the next phase were developed in collaboration with Monadnock Development.

The building at 516 Schroeders Avenue, designed by SLCE Architects, is designated as senior housing. MHG Architects is behind the design of the other buildings, including 1111-1123 Lower Ashford Drive and 127 and 129 Gateway Drive.

The complex includes assigned parking spaces (for some residents), shared laundry rooms, energy-efficient appliances, common area Wi-Fi, a gymnasium, outdoor areas, security cameras and on-site resident managers.

Rendering by SLCE Architects

Applications for the affordable housing lottery must be submitted by December 31, 2020. Apply through NYC Housing Connect. To learn more about how to apply for affordable housing, read Brownstoner’s guide.